Home

/

News and Updates

FRASCO HAILS PBBM’S SIGNING OF VAT REFUND LAW FOR TOURISTS

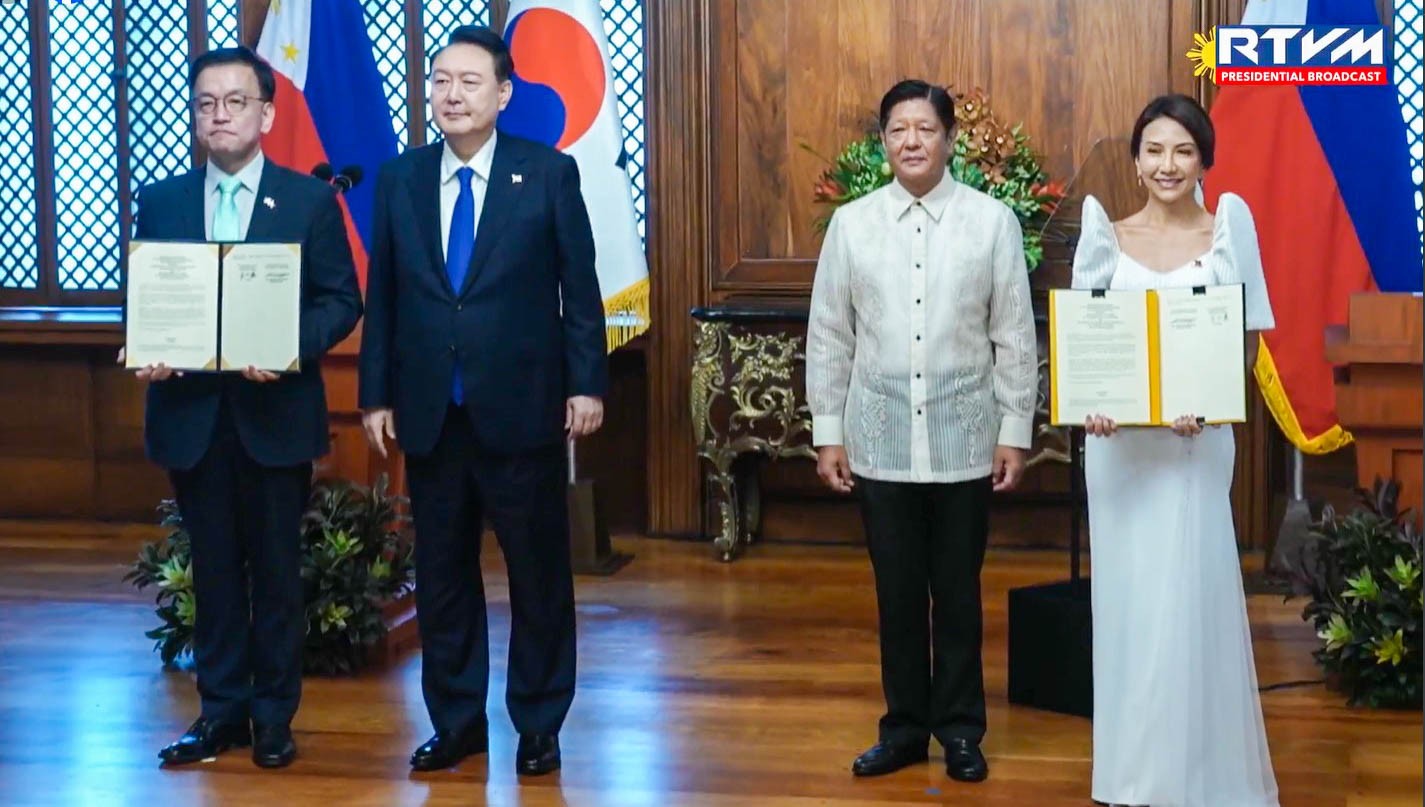

Department of Tourism (DOT) Secretary Christina Garcia Frasco expressed elation at President Ferdinand R. Marcos Jr.‘s signing of the Value-Added Tax (VAT) refund mechanism for non-resident tourists on Monday, December 9. This landmark legislation enhances the Philippines’ position as a premier tourism destination and expands its appeal with affordable shopping options.

In a statement, Tourism Secretary Christina Garcia Frasco praised President Marcos, Jr.’s leadership, leading to the passage of this landmark law which boosts the country’s tourism draw.

“The passage of the VAT Refund Law for tourists marks a monumental shift in the way we enhance the Philippine tourism experience. This not only elevates the country’s competitiveness as a premier destination in Asia but also adds significant value to the overall visitor journey. By allowing tourists to enjoy tax refunds on their purchases, we send a strong message that the Philippines is ready to embrace global standards while supporting local industries and businesses.

This law is more than an economic incentive; it is an invitation for the world to experience the creativity, craftsmanship, and hospitality that make our nation unique. We applaud our President and the Legislature for this forward-thinking legislation, which strengthens our commitment to making the Philippines a more accessible and attractive destination for the global traveler,” Secretary Frasco said.

Key Provisions of the VAT Refund Law

The VAT refund scheme allows non-resident tourists to claim refunds on purchases worth at least ₱3,000 per transaction. Refunds are applicable to goods bought in-person at accredited stores, provided these items are taken out of the country within 60 days of purchase.

The legislation was passed by the Senate as Senate Bill No. 2415 on September 23, 2024, and adopted by the House of Representatives as an amendment to House Bill No. 7292 on September 24, 2024.

Boosting Tourism Spending and Economic Growth

According to the DOT, the VAT refund program is expected to significantly boost tourism-related spending. The House Committee on Ways and Means projects a 29.8% increase in tourist expenditures.

“In 2023, inbound tourism expenditure on shopping reached ₱137.4 billion, highlighting its crucial role in the tourism value chain. Shopping remains a key driver of tourist activity, and this VAT refund scheme is expected to further elevate the country’s appeal,” Secretary Frasco explained.

She added, “From handcrafted souvenirs to premium local brands, the program will encourage tourists to invest in our unique offerings. It will directly benefit micro, small, and medium enterprises (MSMEs), create jobs, and drive economic growth. The projected 29.8% increase in tourist spending demonstrates the transformative potential of this initiative in fostering inclusive development.”

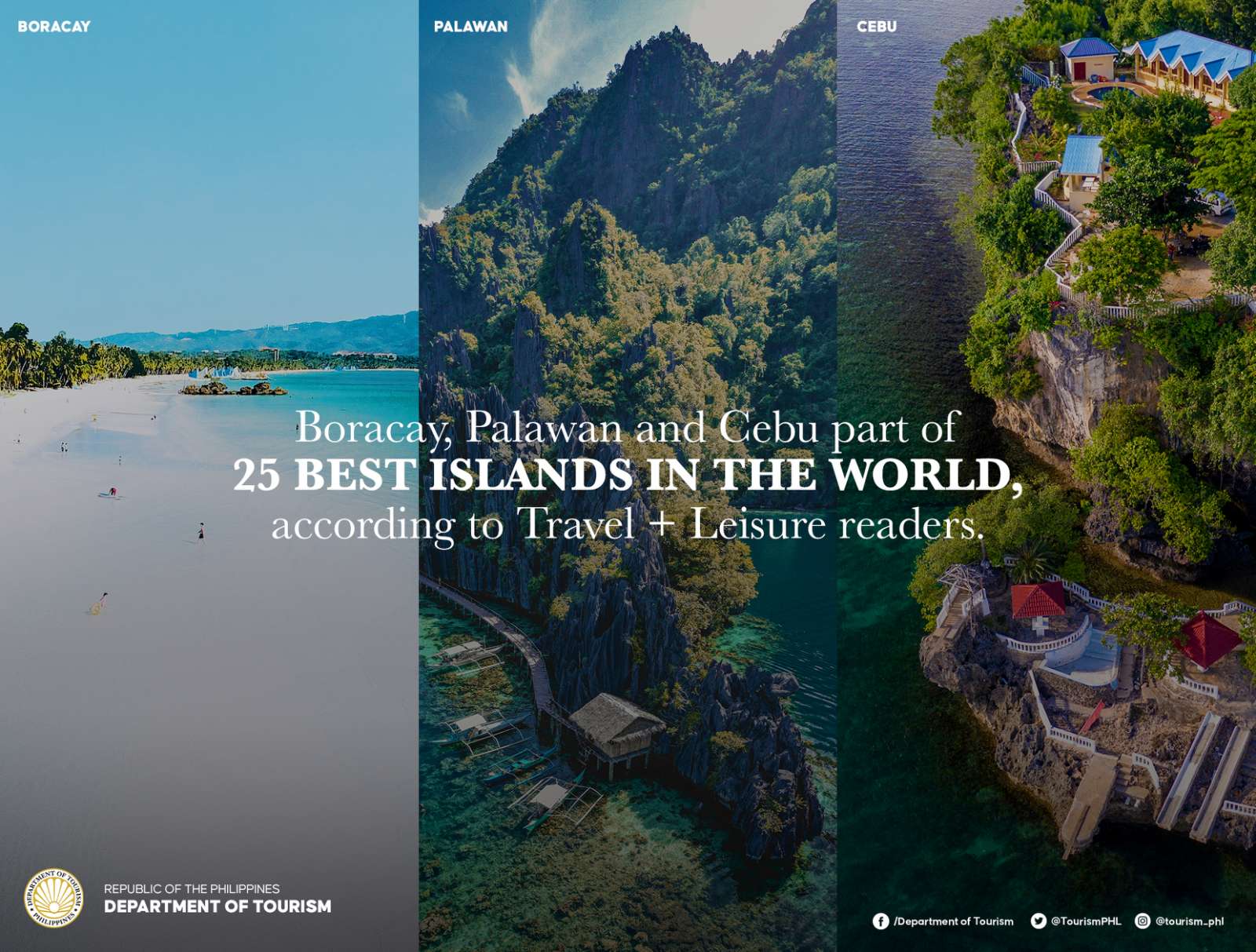

Strengthening the Philippine Tourism Portfolio

The VAT refund mechanism complements the DOT’s ongoing initiatives under the National Tourism Development Plan (NTDP) 2023–2028. These include infrastructure development, enhanced accessibility, and digitalization efforts.

The DOT continues to collaborate with key government agencies on strategic projects:

· Expanding tourism roads in partnership with the Department of Public Works and Highways (DPWH).

· Upgrading airports and seaports with the Department of Transportation (DOTr).

· Improving digital connectivity with the Department of Information and Communications Technology (DICT).

Digital innovations such as the Tourist Assistance Call Center, the enhanced Travel PH app, and the establishment of Tourist Rest Areas across the country are designed to enhance the visitor experience. Meanwhile, visa system improvements and the Cruise Visa Waiver Program, developed with the Bureau of Immigration (BI), the Department of Justice (DOJ), and the Tourism Infrastructure and Enterprise Zone Authority (TIEZA), have made international travel more seamless.

To further enrich the Philippines’ tourism offerings, the DOT has actively promoted niche markets such as gastronomy, health and wellness, Halal and Muslim-friendly tourism, heritage and culture, and sports tourism, including golf and surfing. Programs such as the Philippine Experience Program: Heritage, Culture, and Arts Caravan and the Tourism Champions Challenge for local government units (LGUs), as well as new attractions like the Hop-On Hop-Off Bus Tours in Metro Manila, have added depth to the country’s visitor experiences.

Next Steps

The law mandates the Department of Finance, in consultation with the Department of Trade and Industry, Department of Transportation, Department of Tourism, National Economic and Development Authority, Bureau of Internal Revenue, and Bureau of Customs to draft and release the implementing rules and regulations (IRR) within 90 days from the law’s effectivity.

This VAT refund mechanism marks a significant milestone in enhancing the Philippines’ global competitiveness, reaffirming its commitment to positioning itself as a premier destination in Asia.

-30-

Published:December 9, 2024